EPFO has provided an online facility through which PF amount can be withdrawn using any of these claim

- PF Final Settlement (Form 19)

- Pension Withdrawal Benefit (Form 10C)

- PF Part Withdrawal /Advances – (Form 31 )

This can be accessed from UAN – https://unifiedportal-mem.epfindia.gov.in/memberinterface/

These are the Requirements that a member should satisfy for filling online claims

- UAN should have been activated

- Member’s AADHAAR details should be updated and verified in UAN Portal – How to update AADHAAR?

- Bank account along with IFSC code should be seeded in UAN Portal – How to update Bank account?

- PAN is a must if the Service is less than 5 years

- Date of Joining should be displayed

- Date of Exit from the company should be updated and displayed in the UAN Portal

- Claim can be submitted only after 2 months from Date of Exit

- Member should not working presently

If anyone of the above conditions is not satisfied then the online claims wont be allowed.

For Form 10C these conditions should be met

- Members Total Service should be more than 6 months and less than 9.5 years in addition to the conditions mentioned aboove

Steps for Online Processing of Claim

Step 1: Login into UAN

Step 2: Member should check the conditions mentioned above in the UAN Portal

Step 3: Select the Type of Claim (Form 10C, Form 19 or Form 31)

Step 4: Authenticate using OTP Received against the mobile registered with AADHAAR to complete the online claim submission

After the claim is submitted it will take 0-30 days to process your claim and get the amount credited to your bank account (In some cases, you may get PF Final Settlement much sooner and if there are any issues you might not get Form 10C Pension withdrawal)

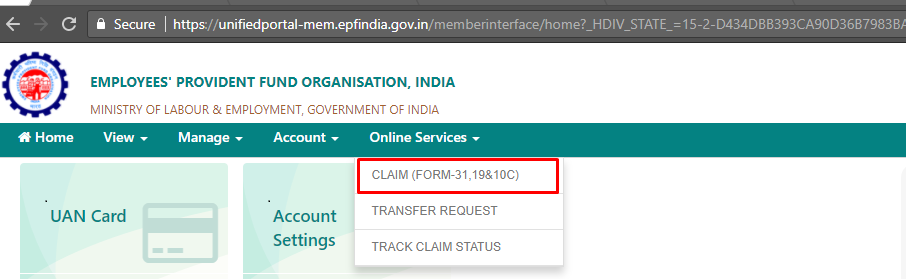

Screenshot of where you can access online claim form in the UAN Portal

Shan is an expert on on Employees Provident Fund, Personal Finance, Law and Travel. He has over 8+ years of experience in writing about Personal Finance and anything that resonates with ordinary citizens. His posts are backed by extensive research on the topics backed by solid proofs