The historic revocation of Article 370 in 2019 brought significant changes to the Indian union territory of Jammu and Kashmir. One of these changes is the extension of the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 (EPF Act) to the region. Now both employers and employees in Jammu and Kashmir are now eligible to participate in the Employees’ Provident Fund (EPF) scheme, a nationwide social security program that provides financial security to workers after retirement.

Previously exempt from the EPF Act and related schemes like EDLI, EPFS, and EPS, establishments in Jammu and Kashmir now fall under the purview of the Employees’ Provident Fund Organisation (EPFO). This move ensures that workers in the region enjoy the same benefits and protections as their counterparts across India.

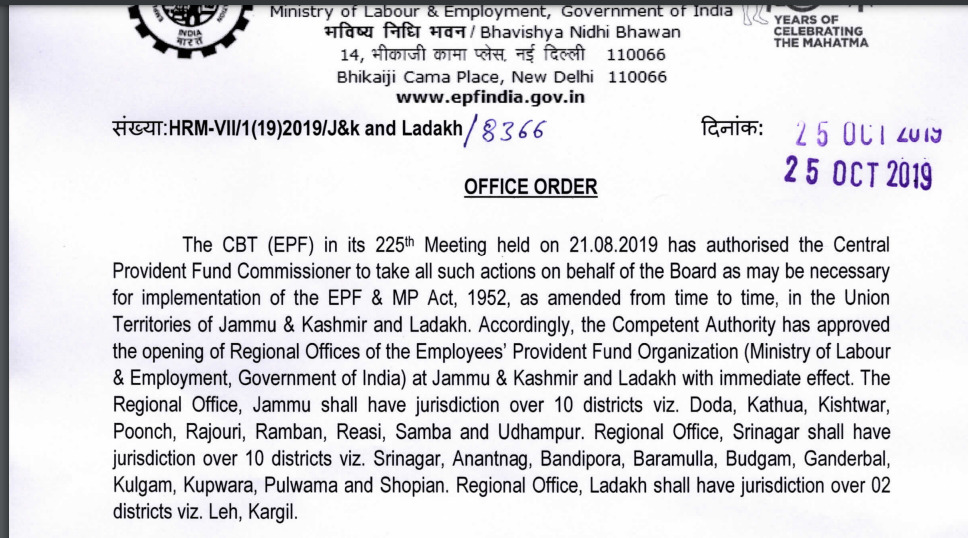

Three Regional PF Offices to Serve the Kashmir Region:

To efficiently manage the influx of new subscribers, the EPFO has established three dedicated Regional PF Offices in Jammu and Kashmir:

- Jammu Regional PF Office: This office will cater to establishments and employees in the districts of Doda, Kathua, Kishtwar, Poonch, Rajouri, Ramban, Reasi, Samba, and Udhampur.

- Srinagar Regional PF Office: The Srinagar office will handle establishments and employees in the districts of Srinagar, Anantnag, Bandipora, Baramulla, Budgam, Ganderbal, Kulgam, Kupwara, Pulwama, and Shopian.

- Ladakh Regional PF Office: This office will serve the districts of Leh and Kargil in the newly formed union territory of Ladakh.

Benefits of EPF for Employers and Employees in Jammu and Kashmir:

The extension of the EPF Act to Jammu and Kashmir offers several benefits for both employers and employees:

For Employers:

- Compliance with national labor laws: By complying with the EPF Act, employers in Jammu and Kashmir ensure they are adhering to national labor regulations.

- Enhanced employee satisfaction: Offering EPF benefits can attract and retain talented employees who value financial security and retirement planning.

- Simplified administration: The EPFO provides a streamlined online platform for managing employee contributions and claims, reducing administrative burden for employers.

For Employees:

- Social security and retirement savings: EPF contributions create a corpus for employees to access upon retirement, providing financial stability in their later years.

- Life insurance coverage: The Employee Deposit Linked Insurance Scheme (EDLI) provides life insurance coverage to EPF subscribers, offering their families financial protection in case of unforeseen circumstances.

- Tax benefits: Contributions made towards EPF are eligible for tax deductions, reducing employees’ taxable income.

Shan is an expert on on Employees Provident Fund, Personal Finance, Law and Travel. He has over 8+ years of experience in writing about Personal Finance and anything that resonates with ordinary citizens. His posts are backed by extensive research on the topics backed by solid proofs