Did you know you can use your EPF corpus for urgent financial needs? Few discuss how to withdraw EPF balance under various categories for unexpected events. Instead of applying for a high-interest personal loan during an emergency, quickly access your EPF funds when you need cash most by following the steps outlined in the below post!

EPF Withdrawal for Illness

You can make use of the EPF Withdrawal under Illness category and withdraw the entire Employee share of your corpus. For instance, if your Employee corpus is Rs 1,00,000 you can withdraw that full amount under the Illness category.

Note: You do not face a limit on the number of times you claim this illness withdrawal. You can use this to pay off existing loans, saving yourself significant interest.

Step by Step Process for EPF Emergency Withdrawal

The process is very similar to the general EPF Process except the category change.

Step 1: Login into UAN Portal with UserID and UAN Password

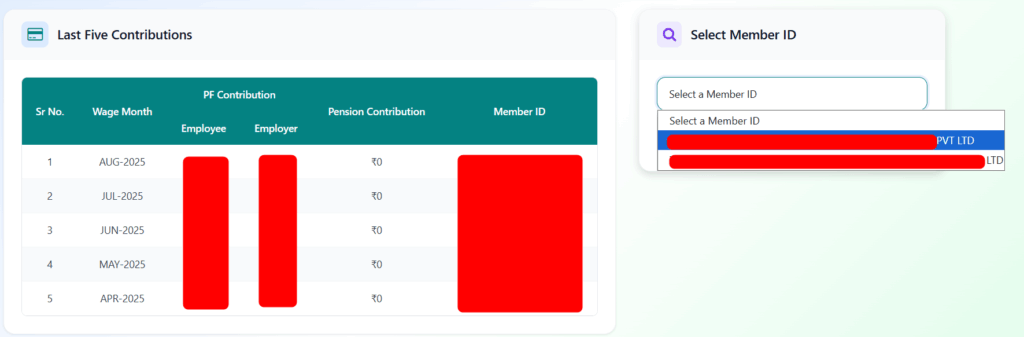

Step 2: Click on View —> Passbook Lite

Step 3: Passbook Lite page will open as shown below. Select Member ID from the right pane

Step 4: Once you select the Member ID, a popup will open which will show the contributions for the entire year (Both Employee and Employer Contributions)

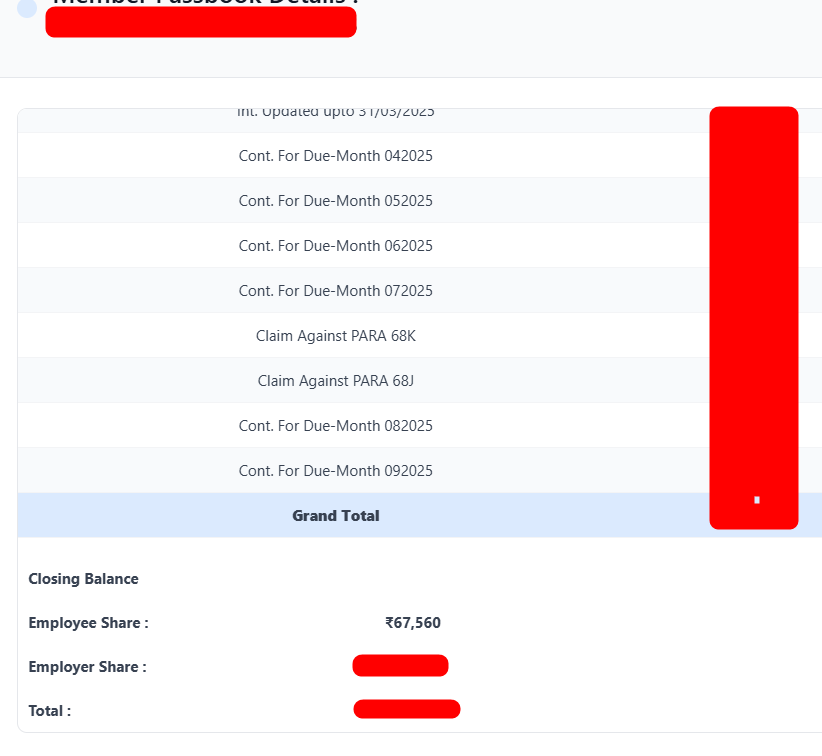

Step 5: On the popup scroll down to the bottom to see the current Employee share corpus (That’s the amount you can apply for EPF Withdrawal under the Illness category)

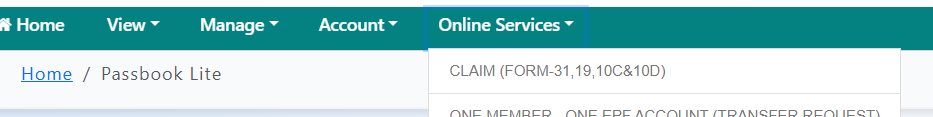

Step 6: Now go to online services and click on “Claim” option

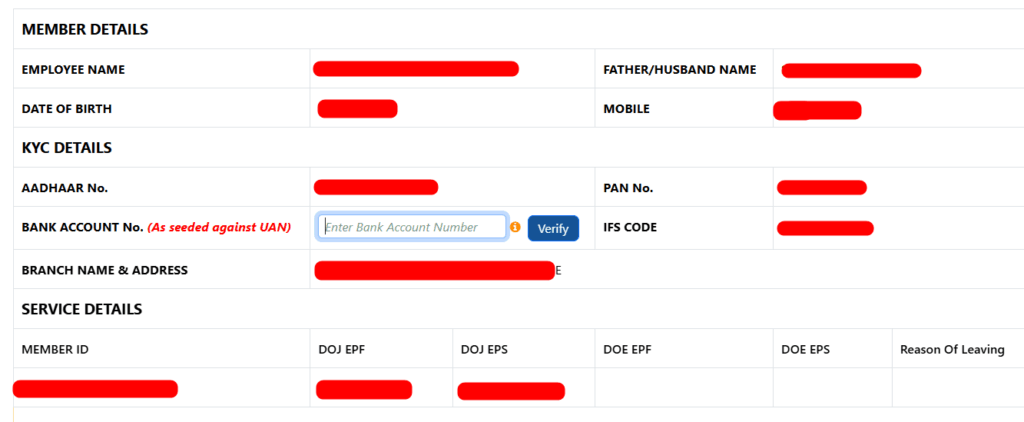

Step 7: Enter the Bank Account Number that has been linked in UAN and then click on Verify

Step 8: Then click on Proceed for Online Claim

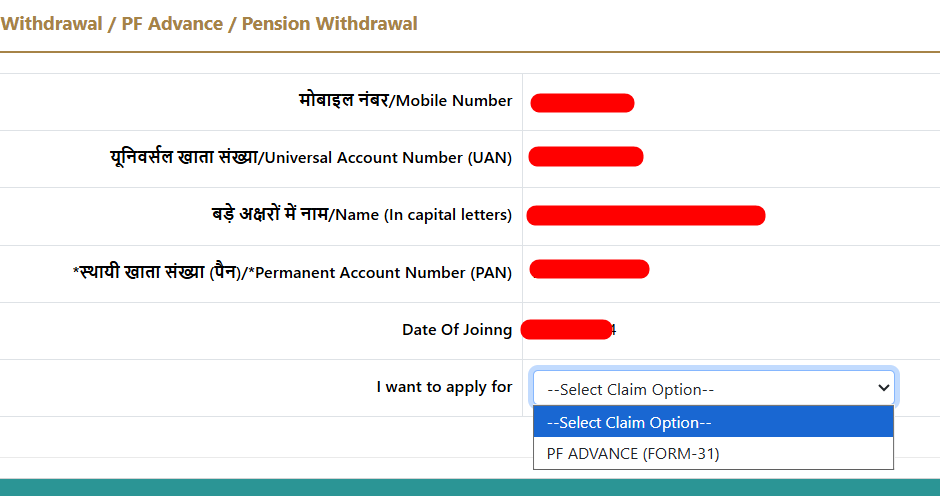

Step 9: Then choose the PF Advance as shown in the next page

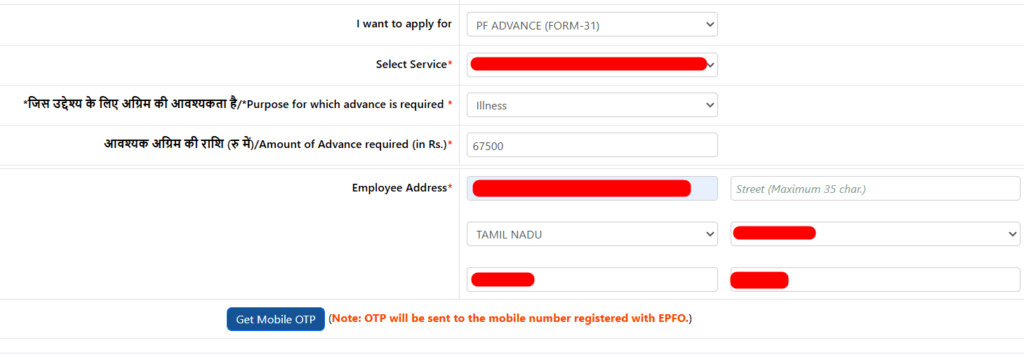

Step 10: Then select the current service from the list of companies you have been employed (This refers to the place where you are currently employed)

Step 11: Choose the advance type as Ilness and then click on Get Mobile OTP

Step 12: Enter the OTP received on your mobile and Verify then the claim will be submitted

This process is very similar to the general EPF Withdrawal process with few changes in the category selection as well the amount which you can apply for (Only Employee share)