If you have checked your salary slip recently and noticed that your net take-home pay has gone down despite your CTC remaining the same (or even after a hike), you are not alone. The implementation of the New Code on Wages has fundamentally changed how salaries are structured in India. The most significant shift is the “50% Basic Wage Rule,” which forces companies to restructure pay packages, directly impacting your monthly cash-in-hand.

New PF Code Salary Impact

- The New Rule: The 50% Mandate

- How This Hits Your Take-Home Pay

- Real-World Calculation: Before vs. After

- Why the Impact is Higher for High Earners

- Is There a Silver Lining?

- What Should You Do?

The New Rule: The 50% Mandate

Previously, many employers structured salaries with a low “Basic Salary” (often 30-40% of CTC) and high “Allowances” (like HRA, Special Allowance, Conveyance, etc.). Since Provident Fund (PF) contributions are calculated only on Basic Salary + DA, keeping the Basic low helped companies and employees keep the PF contribution low and the monthly take-home pay high.

The Change: Under the new wage code, the government mandates that Basic Pay (plus Dearness Allowance) must constitute at least 50% of the total Cost to Company (CTC).

If your allowances exceed 50% of your total compensation, the excess amount is automatically added back to the “Basic” component for the purpose of calculating PF.

How This Hits Your Take-Home Pay

When your Basic Salary is forced upward to meet the 50% threshold, your mandatory PF contribution (which is 12% of Basic) automatically increases.

Since PF is deducted directly from your salary, a higher deduction means less money credited to your bank account at the end of the month.

Real-World Calculation: Before vs. After

Let us take a example of 2 employees one with a wage of ₹5,00,000 CTC and another with wage og ₹50,000 CTC

An employee with an annual CTC of ₹5,00,000 will have 600 reduced from his/her take homepay every month!

| Component | Old Structure (Low Basic) | New Structure (50% Rule) |

| Monthly CTC | ₹5,00,000 | ₹5,00,000 |

| Basic Salary | ₹2,00,000 (40% of CTC) | ₹2,50,000 (50% of CTC) |

| Allowances | ₹3,00,000 | ₹2,50,000 |

| PF Contribution (Employee) (12% of Basic) | ₹24,000 | ₹30,000 |

| Take-Home Pay (Pre-Tax) | ₹4,76,000 | ₹4,70,000 |

| Monthly Loss | – | ₹500 |

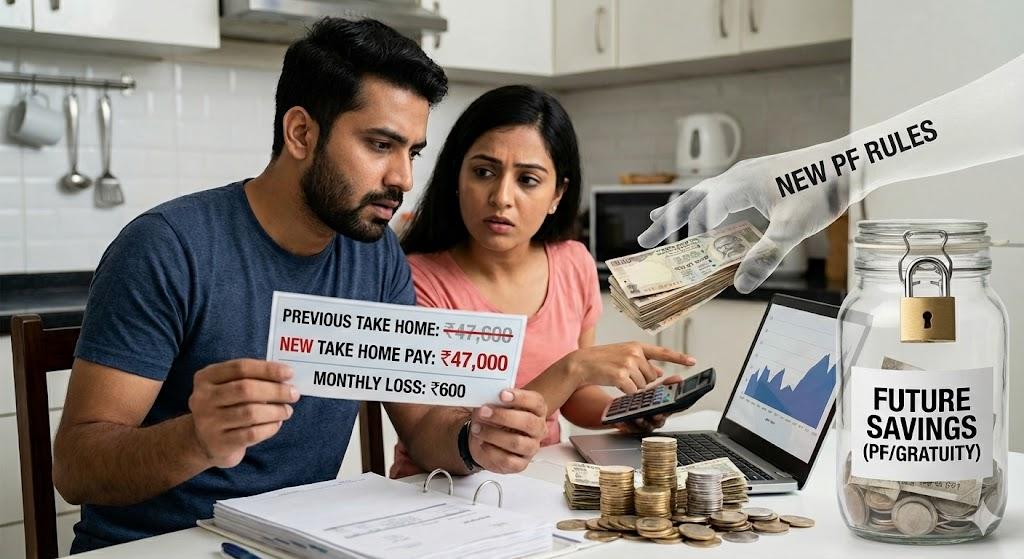

An employee with an annual CTC of ₹500,000 will have ₹60 reduced from his/her take homepay every month!

| Component | Old Structure (Low Basic) | New Structure (50% Rule) |

| Basic Salary | ₹20,000 (40% of CTC) | ₹25,000 (50% of CTC) |

| Allowances | ₹30,000 | ₹25,000 |

| Total Gross | ₹50,000 | ₹50,000 |

| PF Contribution (Employee) (12% of Basic) | ₹2,400 | ₹3,000 |

| Take-Home Pay (Approx) | ₹47,600 | ₹47,000 |

| Monthly Loss | – | ₹60 per month |

(Note: This is a simplified calculation excluding professional tax and income tax for clarity.)

In this example, the employee takes home ₹600 less every month simply because the Basic Salary component was increased to meet the compliance requirement. For higher salary brackets, this difference can run into thousands of rupees.

Why the Impact is Higher for High Earners

For those in the ₹5 Lakh+ monthly bracket, the “Allowances” component (HRA, LTA, Vehicle Allowance, etc.) was traditionally kept very high to optimize tax.

- The Shift: By forcing 50% into Basic, the taxable salary structure changes significantly.

- The Gratuity Factor: On the flip side, a Basic increase from ₹2L to ₹2.5L increases the Gratuity payout significantly, which is a massive hidden benefit for long-term employees in this bracket.

Is There a Silver Lining?

While a thinner wallet today hurts, this change is actually beneficial for your long-term financial health. Here is why:

- Bigger Retirement Corpus: The extra money deducted isn’t “lost”; it is going into your EPF account. Because your contribution is higher, the compounding interest (currently 8.25%) works on a larger principal, leading to a much larger corpus at retirement.

- Higher Gratuity: Gratuity is also calculated based on Basic Salary. A higher Basic means your gratuity payout (received after 5 years of service) will be significantly higher.

- Tax Saving: The increased PF contribution is eligible for tax deduction under Section 80C, which might help reduce your income tax liability.

What Should You Do?

- Check Your Pay Slip: Compare your current pay slip with one from a few months ago. Look specifically at the “Basic” and “Provident Fund” line items.

- Review Your Budget: If the drop in take-home pay is significant, you may need to adjust your monthly budgeting or SIPs.

- Don’t Panic: Remember that this is a statutory change applicable to all employees across India, not a pay cut imposed by your specific company.