Navigating the world of employee provident funds (EPF) can be confusing, especially when dealing with establishment codes and details. But worry not! This guide simplifies the process, showing you how to easily find the PF code and details of any establishment using the EPFO Establishment Search.

Step-by-Step Guide for finding PF Code:

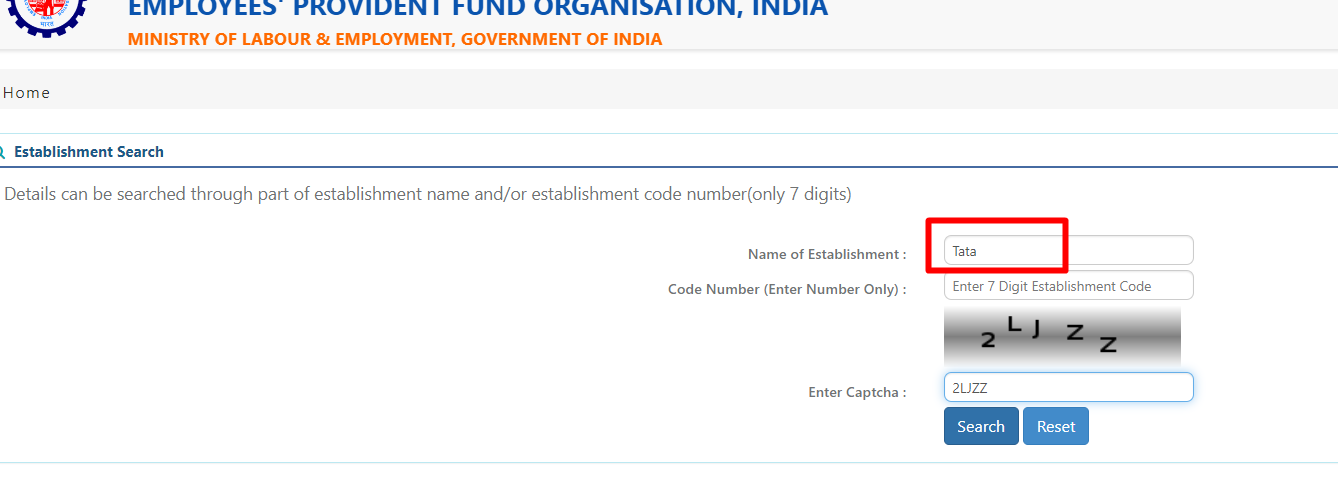

- Head to the PF Establishment Search: Visit https://unifiedportal-epfo.epfindia.gov.in/publicPortal/no-auth/misReport/home/loadEstSearchHome to access the search portal.

- Enter Required Information: You can either:

- Enter the name of the PF establishment in the designated field.

- Enter the PF code of the establishment if you already know it.

- Complete the Captcha: Ensure you correctly decipher and enter the Captcha code displayed.

- Click “Search”: Hit the “Search” button to initiate your query.

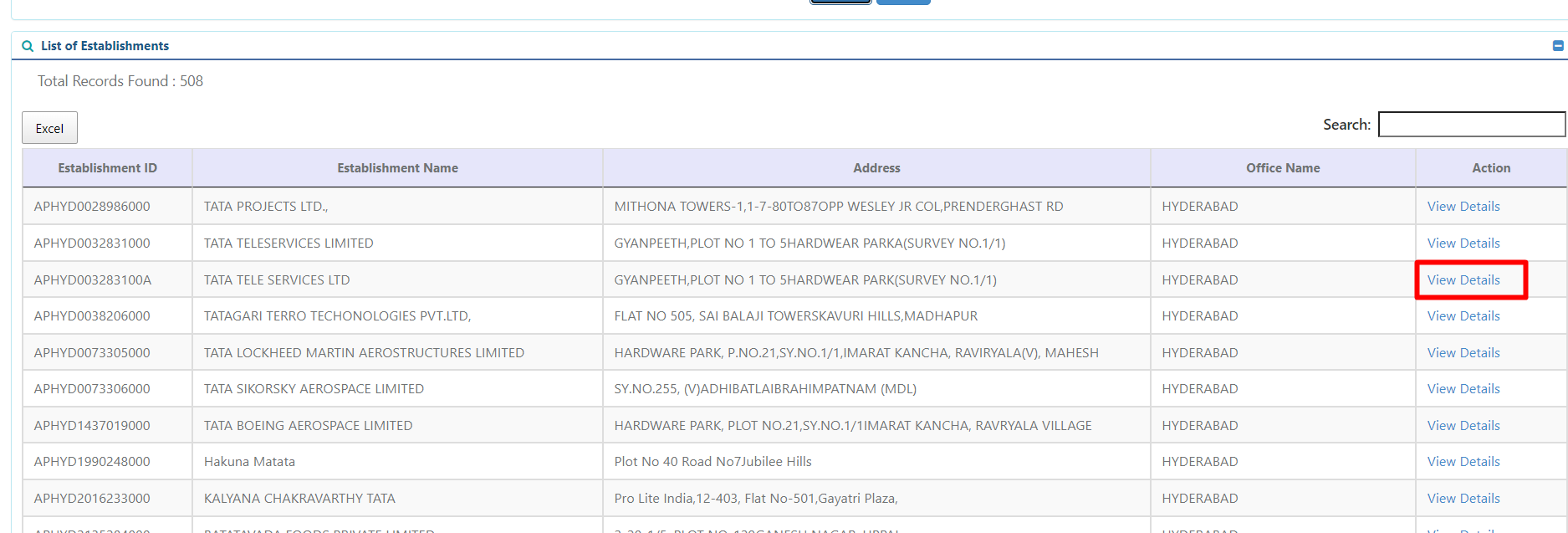

- Review Results: The search will display a list of PF establishments matching your criteria.

- View Details: To delve deeper, click “View Details” next to the relevant establishment.

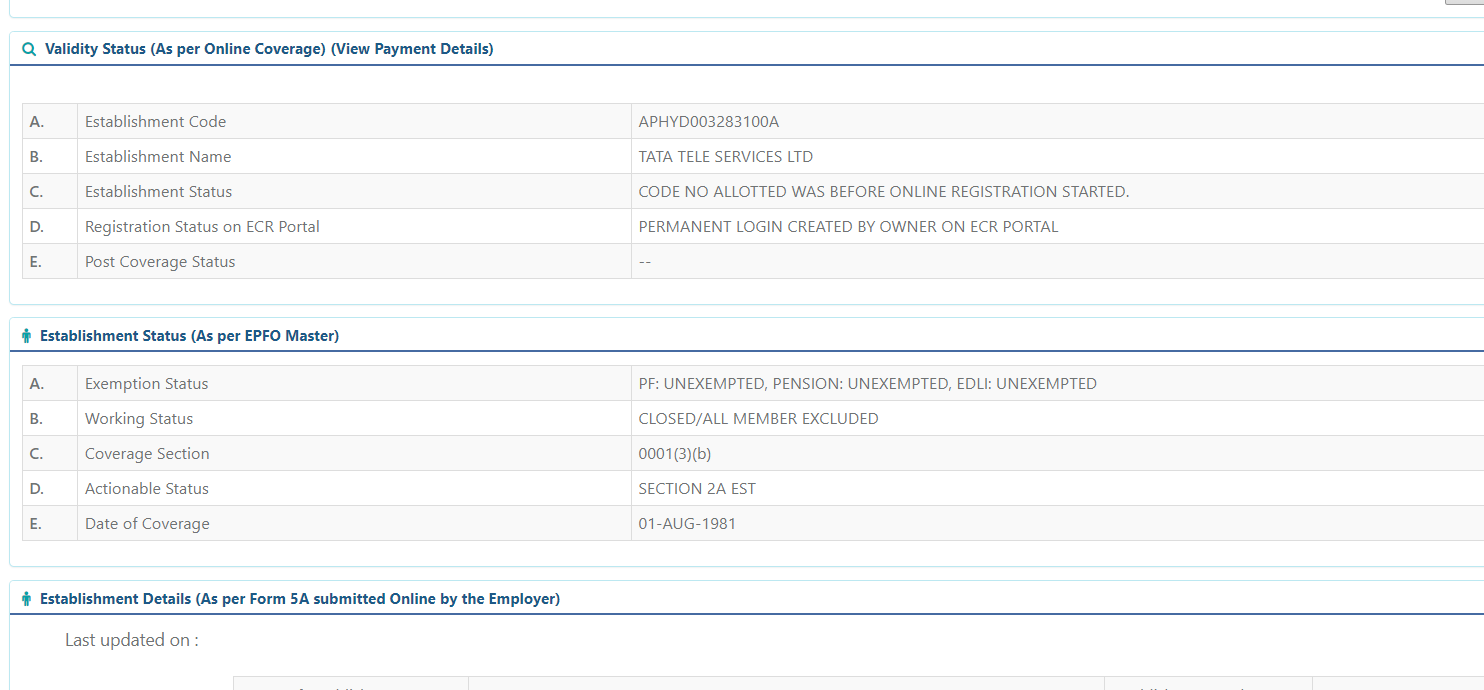

- Access Information: This detailed page provides crucial information like:

- PF Establishment Code: Unique 7-digit code assigned by the regional PF office.

- Establishment Name: Official name of the company.

- Status: Active or inactive status of the establishment.

- Exemption Status: Clarifies if the establishment is exempted from contributing to EPF.

Understanding PF Codes:

- Each PF establishment receives a unique 7-digit code.

- This code is specific to the regional PF jurisdiction where the company operates.

- For example, a company headquartered in Chennai might have a PF code like “TNMAS0031309000,” which translates to “TN/MAS/0031309/000” (with the actual company code being 31309).

Benefits of Finding PF Details:

- Verification: Confirm if a company contributes to EPF for its employees.

- Investment Decisions: Assess an employer’s financial stability and commitment to employee benefits.

- Claim Processing: Streamline the process of claiming PF benefits.

Regularly update your KYC information on the EPFO portal to ensure smooth account access and timely claim processing.

source: www.epfindia.govin

Shan is an expert on on Employees Provident Fund, Personal Finance, Law, Travel and Visa related queries. He has over 8+ years of experience in writing about Personal Finance and anything that resonates with ordinary citizens. And his posts are always backed by solid research on the above said topics.